does td ameritrade provide tax documents

TD Ameritrade Singapore Pte. TD Ameritrade Inc member FINRASIPC.

TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company Inc.

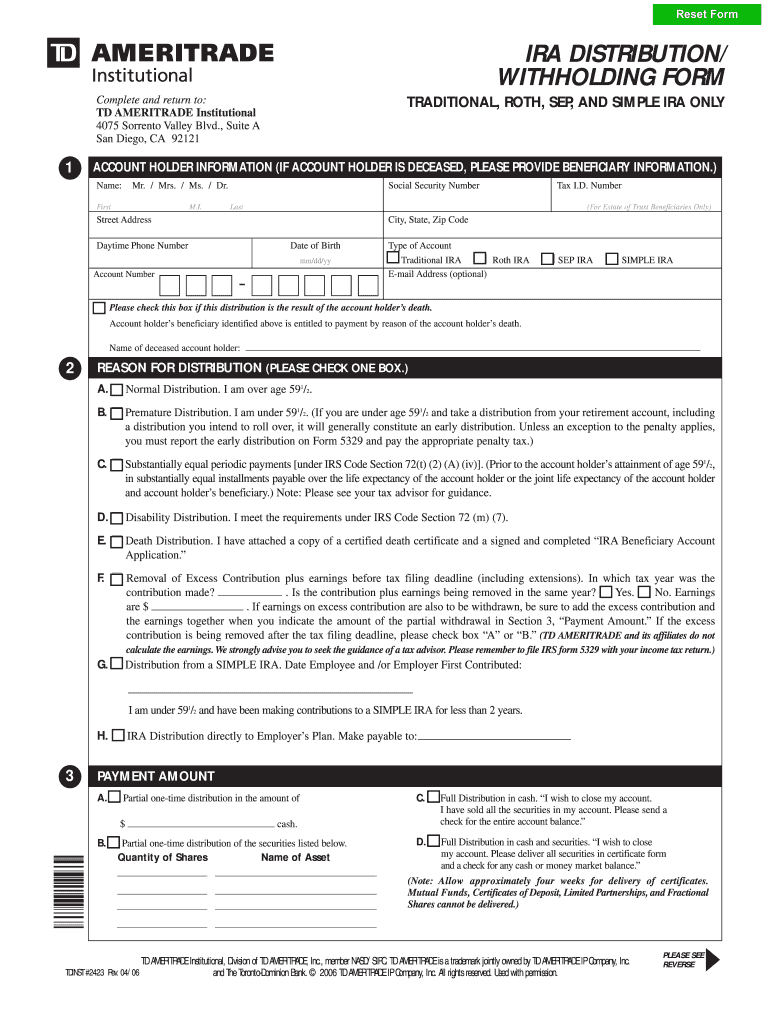

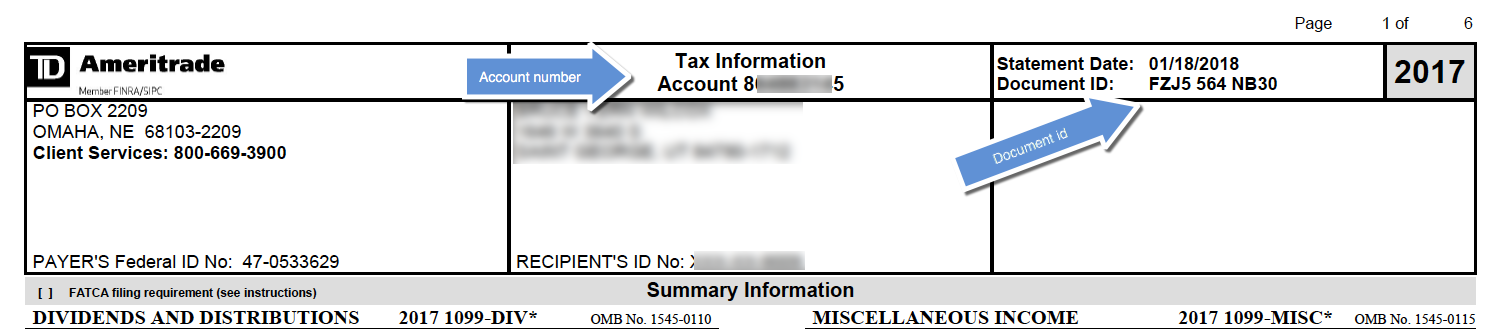

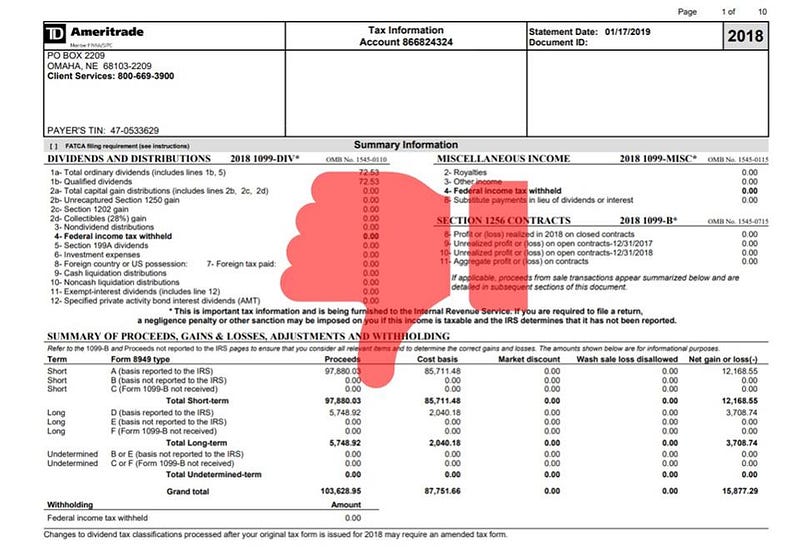

. Tracking your cost-basis To figure out your gainloss you need to know the original value of the asset or cost basis including adjustments such as sales commissions or transaction fees. Does TD Ameritrade provide tax documents. You must send Copies A of all paper Forms 1097 1098 1099 3921 3922 5498 and W-2G to the IRS with Form 1096 Annual Summary and Transmittal of US.

Do you send 1099 forms to IRS. Scroll down to Cost basis reporting provided by GAINSKEEPER Select 20XX with wash sale adjustments 8949. Please have clients consult with a tax-planning professional with regard to their personal circumstances.

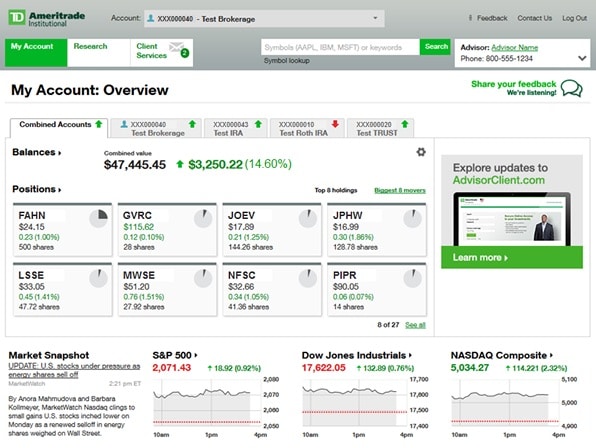

Proceeds not reported to the IRS does this mean I dont have to report these proceeds. Get all of your important tax filing forms all in one convenient place. Select the My Account tab.

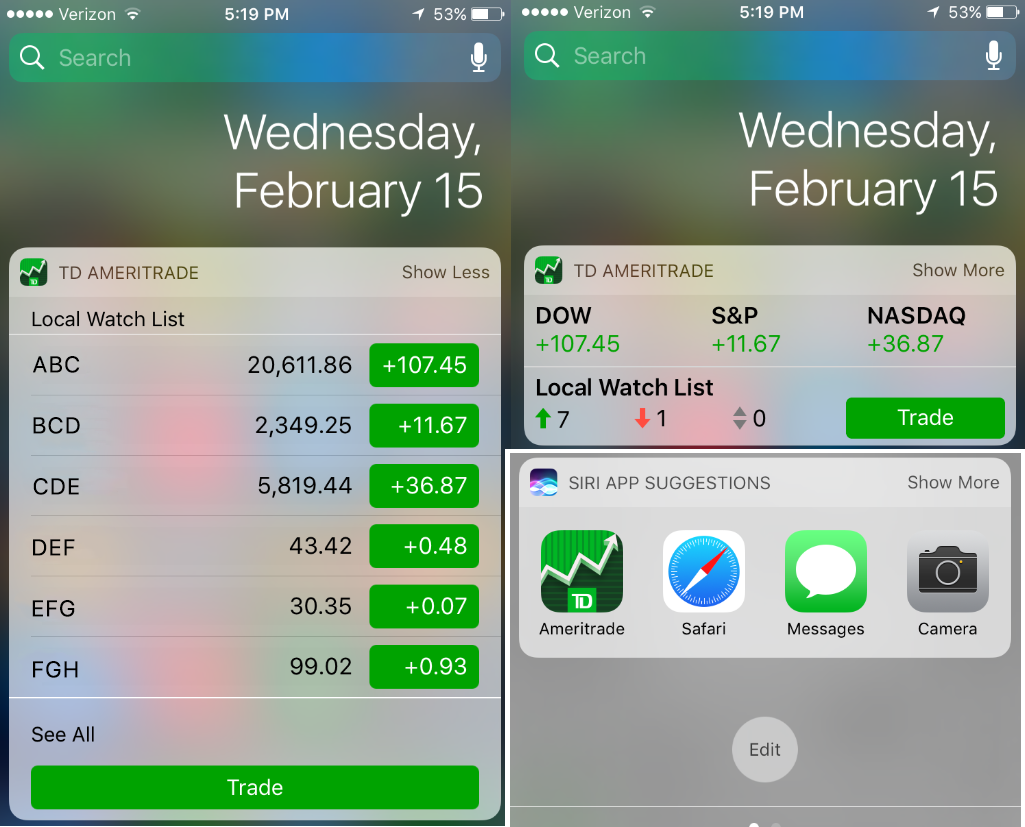

Jensen said the documents come in PDF format so you can view or download your statements from a computer laptop tablet or mobile device. The form covers the following areas. TD Ameritrade does not provide this form.

What other forms does TD Ameritrade use to report to the IRS. Market volatility volume and system availability may delay account access and trade executions. In the pop-up window select Topic Search.

1099-R Distributions from retirement plan accounts. Jensen said the documents come in PDF format so you can view or download your statements from a computer laptop tablet or mobile device. Does TD Ameritrade provide tax documents.

If your return isnt open youll need to sign in and click Take me to my return Click Tax Tools lower left of your screen. TD Ameritrade will not determine if applicable holding periods have been met. From the TD Ameritrade home page.

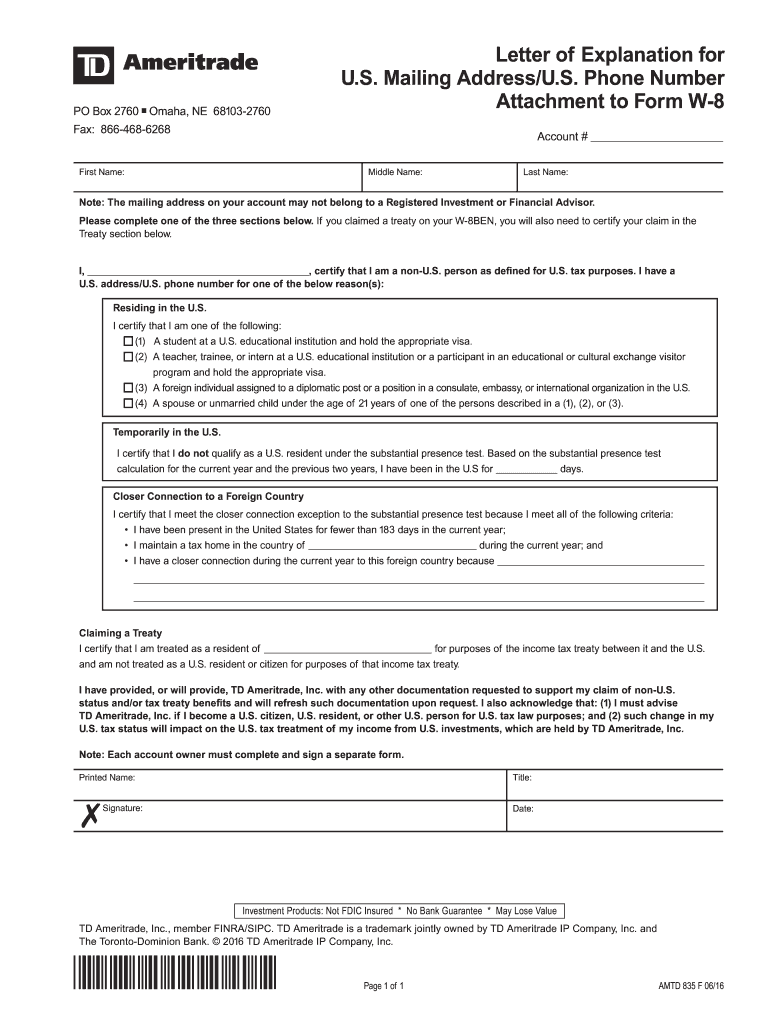

TD Ameritrade does not provide tax advice. TD Ameritrade does not provide legal or tax advice and this information is not intended to be relied upon as such. TD Ameritrade Institutional Division of TD Ameritrade Inc member SIPCFINRANFA.

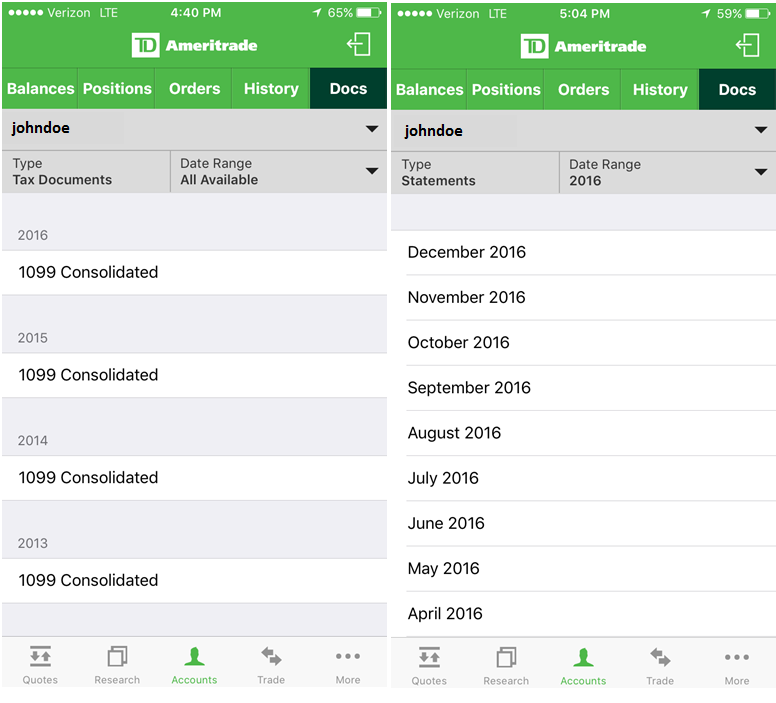

Holding period requirements that must be met to be eligible for this lower tax rate. The TD Ameritrade Mobile app now has up to 7 years of tax documents and 10 years of statements available from your iOS or Android device. 1099-R Distributions from retirement plan accounts.

TD Ameritrade provides a downloadable tax exchange format file containing your realized gain and loss information. TD Ameritrade will report a dividend as qualified if it has been paid by a US. TD Ameritrade clients can sign up for electronic delivery of tax documents and stop receiving paper documents.

Please consult with a legal or tax-planning professional with regard to your personal circumstances. TD Ameritrade stores up to seven years of tax documents in your account and you can access these materials 24 hours a day wherever you are. Be directed to your tax advisor.

This section is very useful for information about reportable transactions tax documents availability tax reporting questions and RMD calculations just to name a few. What other forms does TD Ameritrade use to report to the IRS. Or qualified foreign corporation and it is readily tradable on a US.

175 Branches Nationwide Go City State Zip. Interest Income Form 1099-INT reports all interest payments such as bond interest. 2nd Correction Cycle March 8 2017 Reports reclassified income that was reported to TD Ameritrade between 2152016 and 2282016.

TD Ameritrade is not responsible for payment reallocations that result in the issue of a corrected Consolidated Form 1099 and will not be held liable for any fees incurred for the refiling of a tax form. Anything else you want the Accountant to know before I connect you. This information is provided for educational purposes only.

To speak with a Tax Services Representative call 800 -669 -3900 Monday through Friday from 9 am. TD Ameritrade stores up to seven years of tax documents in your account and you can access these materials 24 hours a day wherever you are. Your TD Ameritrade Consolidated Form 1099 Weve consolidated five separate 1099 forms into one comprehensive form containing information we report to the IRS.

Download this file and submit it for processing by our program. Get in touch Call or visit a branch Call us. TD Ameritrade Inc member FINRASIPC.

We suggest you consult with a tax-planning professional with regard to your personal circumstances. TD Ameritrade has settled for 23 million with a certified class of consumers who accused Scottrade a brokerage firm that TD acquired in 2017 of. With TurboTax Its Fast And Easy To Get Your Taxes Done Right.

Click on the Tax Center menu item. Get Your Max Refund Today. My TD Ameritrade Tax Statement shows.

In addition to the information reported on a Consolidated Form 1099 shown at left TD Ameritrade uses the following forms to report income and securities transactions to the IRS. My 1099 B shows. TD Ameritrade does not provide tax advice.

3rd Correction Cycle March 22 2017. TD Ameritrade does not provide legal or tax advice and this infor mation is not intended to be relied upon as such. TD Ameritrade does not provide tax advice.

Have you talked to a tax professional about this. We suggest you consult with a tax -planning professional with regard to. Continue your return in TurboTax Online.

Retrieve your tax documents or statements by navigating to Accounts selecting the account and navigating over to. TD Ameritrade handles all taxable reporting for your clients accounts and the distribution of your clients tax documents. And nothing in the published material is an offer or solicitation to conduct business in any other jurisdiction.

Products and services offered in Singapore are provided by TD Ameritrade Singapore Pte. Reports reclassified income not captured on Consolidated 1099 forms to be issued in mid-February 2017 that was reported to TD Ameritrade between 292016 and 2142016. In addition to the information reported on a Consolidated Form 1099 shown at left TD Ameritrade uses the following forms to report income and securities transactions to the IRS.

TD Ameritrade Institutional does not provide tax advice. 200902152D is licensed by the Monetary Authority of Singapore and does not provide tax legal or investment advice or recommendations. You can import your 1099-B from TD Ameritrade because it participates in the TurboTax Partner program.

Access the TD Ameritrade platform. We suggest that you seek the advice of a tax advisor with regard to your personal circumstances. Please consult with a legal or tax -planning professional with regard to y our personal circumstances.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Tax Season And More Made Simpler With The Td Amerit Ticker Tape

Td Ameritrade Ofx Import Instructions

How To Read Your Brokerage 1099 Tax Form Youtube

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

Irs Form W 8ben Td Ameritrade 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

Td Ameritrade Account Access Lifeguide Financial Advisors

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

Are You Considering These 4 Things When Choosing A Crypto Tax Software Cointracker

Find Your 1099 On Td Ameritrade Website Tutorial Youtube

Will I Get Tax Documents From Ameriprise And Td Ameritrade Hicks Associates

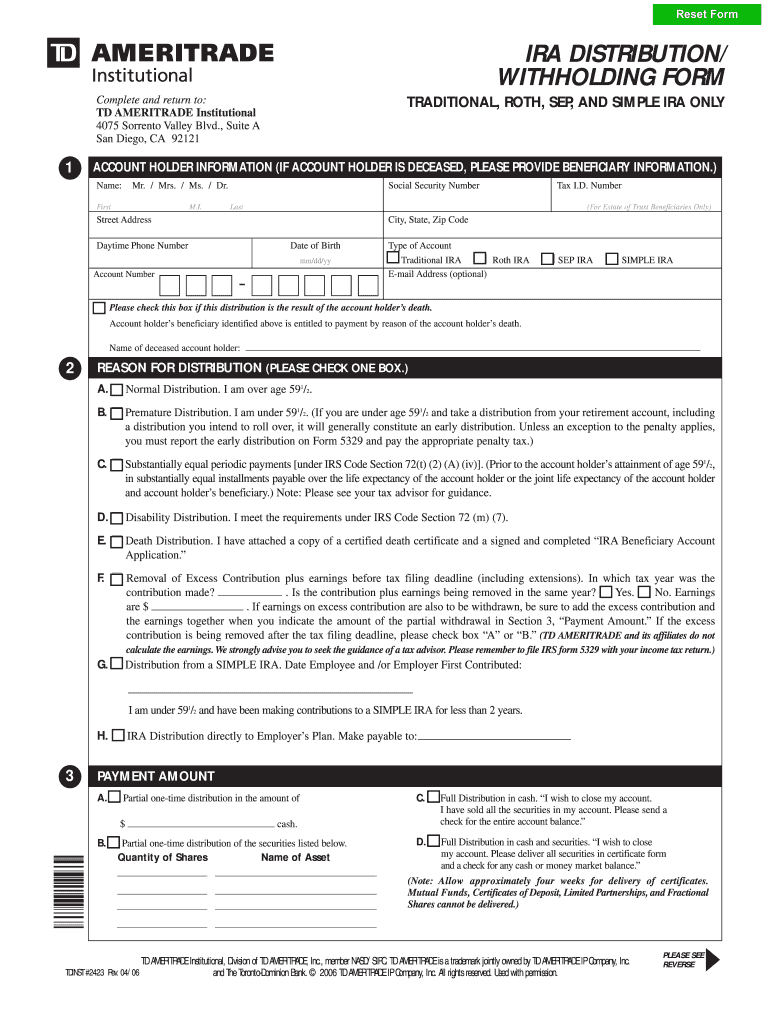

Ameritrade Ira Distribution Withholding Form Fill Online Printable Fillable Blank Pdffiller

Tax Season And More Made Simpler With The Td Amerit Ticker Tape